14. Arms production and military services

Sales by the SIPRI Top 100 arms-producing and military services companies declined for the fourth consecutive year in 2014. Their combined revenue in 2014 was US $401 billion—1.5 per cent lower than in 2013. However, despite the continuing fall, turnover in 2014 was 43 per cent higher than that of the SIPRI Top 100 companies in 2002. This emphasizes the modest level of the decrease observed since the peak in sales reached in 2010, and a slowing in the rate of decline in recent years.

Companies based in the United States and Western Europe continue to dominate the Top 100 revenues, with a combined share of 80.3 per cent of total Top 100 arms sales for 2014. Although this predominance is unlikely to change in the near future, it has been eroding in the wake of the 2008 financial crisis and the end of major US-led military operations in the Middle East.

With a combined increase of 10 per cent, the significant growth in Russian companies’ revenues has partially offset the decline of Western‑based companies.

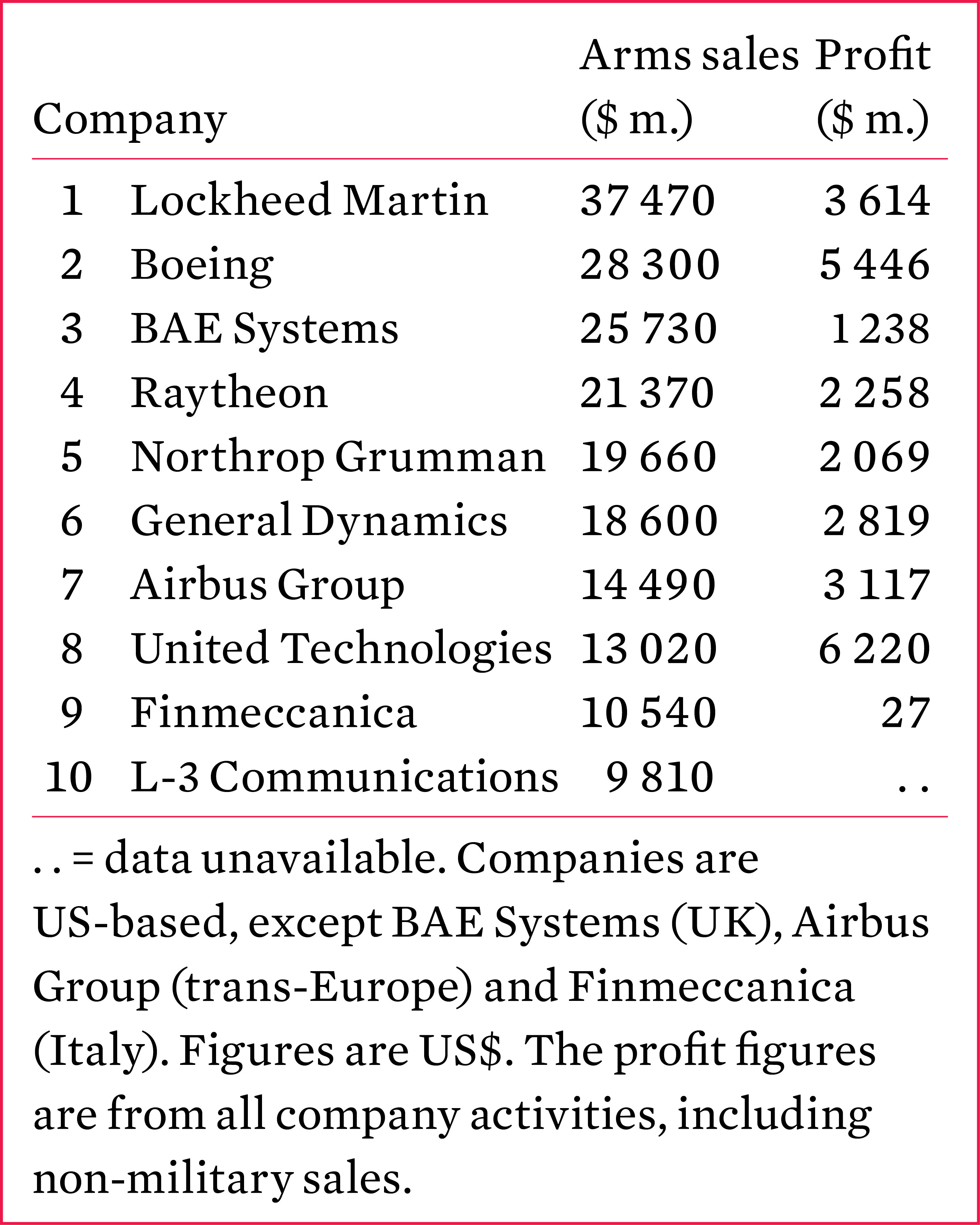

The 10 largest arms-producing companies, 2014

Emerging producers

Other ‘established producers’ ranked in the Top 100 increased their arms sales by 6 per cent in 2014. This rise was mainly due to large increases in arms sales by Polish company PGZ (up 98.4 per cent in real terms) following a major industry consolidation process. Australia and Japan increased their arms sales by 17.5 and 14.7 per cent respectively.

Firms based in the four ‘emerging producer’ states ranked in the Top 100 (Brazil, India, South Korea and Turkey) realized a collective increase in revenues of 5.1 per cent in 2014, helping to mitigate the fall in Top 100 sales. These companies benefit from significant domestic spending on weapons acquisition but are now offering their products internationally. Brazil secured the largest increase in arms sales in 2014 (24.7 per cent) followed by South Korea (10.5 per cent) and Turkey (9.5 per cent). Indian companies showed an overall 7.1 per cent decrease in sales in 2014.

Falling gross domestic product in countries that derive a significant proportion of their income from oil revenues, such as Russia, Saudi Arabia and Venezuela, could change the dynamics that have influenced the Top 100 in the past four years as military budgets are reconciled with national revenues. Export prospects might disappear as importing countries decide how to manage reductions in their revenues. That said, security concerns in East Asia and the Middle East might lead states to continue to prioritize military spending and arms procurement.