5. Arms production and military services

Overview, Susan T. Jackson [PDF]

I. Key developments in the main arms-producing countries, Susan T. Jackson [PDF]

II. The military services industry, Susan T. Jackson [PDF]

III. The Indian arms-production and military services industry, Susan T. Jackson and Mikael Grinbaum [PDF]

IV. The SIPRI Top 100 arms-producing and military services companies, 2010, Susan T. Jackson [PDF]

Summary

The public spending crisis in the Global North has not yet had a large overall impact on the major companies in the arms production and military services industry (‘the arms industry’). The most likely reason for this lack of major change is that the impact of the world financial slowdown is being delayed by the structure of the arms industry.

The economic and spending uncertainties in both the USA and Western Europe will have general implications for the way in which weapon programmes are developed and implemented, and so have contributed to uncertainty as to whether arms sales will be maintained or increase at the same rate as in the past.

The US National Defense Authorization Act

The National Defense Authorization Act for financial year 2012 has sent a mixed message about the US arms industry. On the one hand, it maintains many of the USA’s largest and most costly weapon programmes, such as the F-35 (Joint Strike Fighter). Authorization to continue spending on these programmes indicates that arms sales in the US market are likely to continue largely unchanged from current levels. On the other hand, new contract rules on risk sharing between the US Government and the companies winning arms contracts mean that a potentially heavier burden will fall on the industry as these programmes develop.

Arms industry production cooperation in Western Europe

The financial crisis has seeped into the discussions on arms industry cooperation in Western Europe, although these discussions have not yet resulted in widespread increased cooperation.

West European countries have discussed and begun to implement cooperative development and production strategies for unmanned aerial systems (UASs) and in June 2011 the European Commission initiated a process for developing and producing UASs. However, these projects have not yet come to fruition, as seen in the stagnation of the Talarion project.

The military services industry

Some key military services sectors—such as maintenance, repair and overhaul (MRO), systems support, logistics, and training of foreign militaries—have been more resistant to the impact of the drawdown from Iraq and to the global financial instability. Their long-term growth can be attributed to a variety of post-cold war changes, including structural transformation of military needs and the decrease of in-house capabilities for ever more complex systems. It seems that pressure on public spending, which has raised the possibility that military spending will fall, will contribute to an increase in demand for outsourced services such as weapon systems MRO.

Diversification into cybersecurity

In addition to an increased focus on military services, companies are relying on other business strategies in an effort to maintain their bottom lines. A notable development has been the growth in acquisitions of specialist cybersecurity firms as the largest arms-producing companies attempt to shield themselves from potential cuts in military spending and move into adjacent markets.

The Indian arms industry

Many countries outside the Global North are attempting to develop a self-sustaining national arms industry. India’s efforts to modernize, upgrade and maintain the equipment of its armed forces and to expand its military capabilities have made it the largest importer of major arms.

Its domestic arms industry is also attempting to meet this demand—for example by increasing levels of technology through technology transfer—but the Indian defence industrial policy requires major reform.

The SIPRI Top 100 arms-producing and military services companies

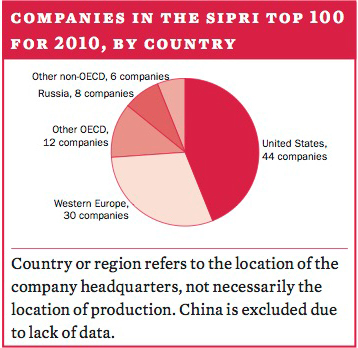

The SIPRI Top 100 list ranks the largest arms-producing and military services companies in the world (outside China) according to their arms sales. Sales of arms and military services by the SIPRI Top 100 continued to increase in 2010 to reach $411.1 billion, although at 1 per cent in real terms the rate of increase was slower than in 2009. Between 2002 and 2010 Top 100 arms sales rose by 60 per cent.

Companies based in the USA remained at the top of the SIPRI Top 100 and were responsible for over 60 per cent of the arms sales in the SIPRI Top 100. The number of West European companies in the Top 100 declined to 30, while the Brazilian company Embraer re-entered the Top 100. Russia’s continued arms industry consolidation added another parent corporation to its top arms producers—United Shipbuilding Corporation.