4. Military expenditure and arms production

Contents

- Overview [PDF]

SAM PERLO-FREEMAN

- I. Global developments in military expenditure [PDF]

SAM PERLO-FREEMAN, CARINA SOLMIRANO AND HELEN WILANDH

- II. US military expenditure [PDF]

SAM PERLO-FREEMAN

- III. Military spending and regional security in the Asia–Pacific [PDF]

SAM PERLO-FREEMAN AND CARINA SOLMIRANO

- IV. The reporting of military expenditure data to the United Nations [PDF]

NOEL KELLY

- V. The SIPRI Top 100 arms-producing and military services companies in 2012 [PDF]

SAM PERLO-FREEMAN AND PIETER D. WEZEMAN

- VI. Military expenditure data, 2004–13 [PDF]

SAM PERLO-FREEMAN, NEIL FERGUSON, NOEL KELLY, CARINA SOLMIRANO AND HELEN WILANDH

Summary

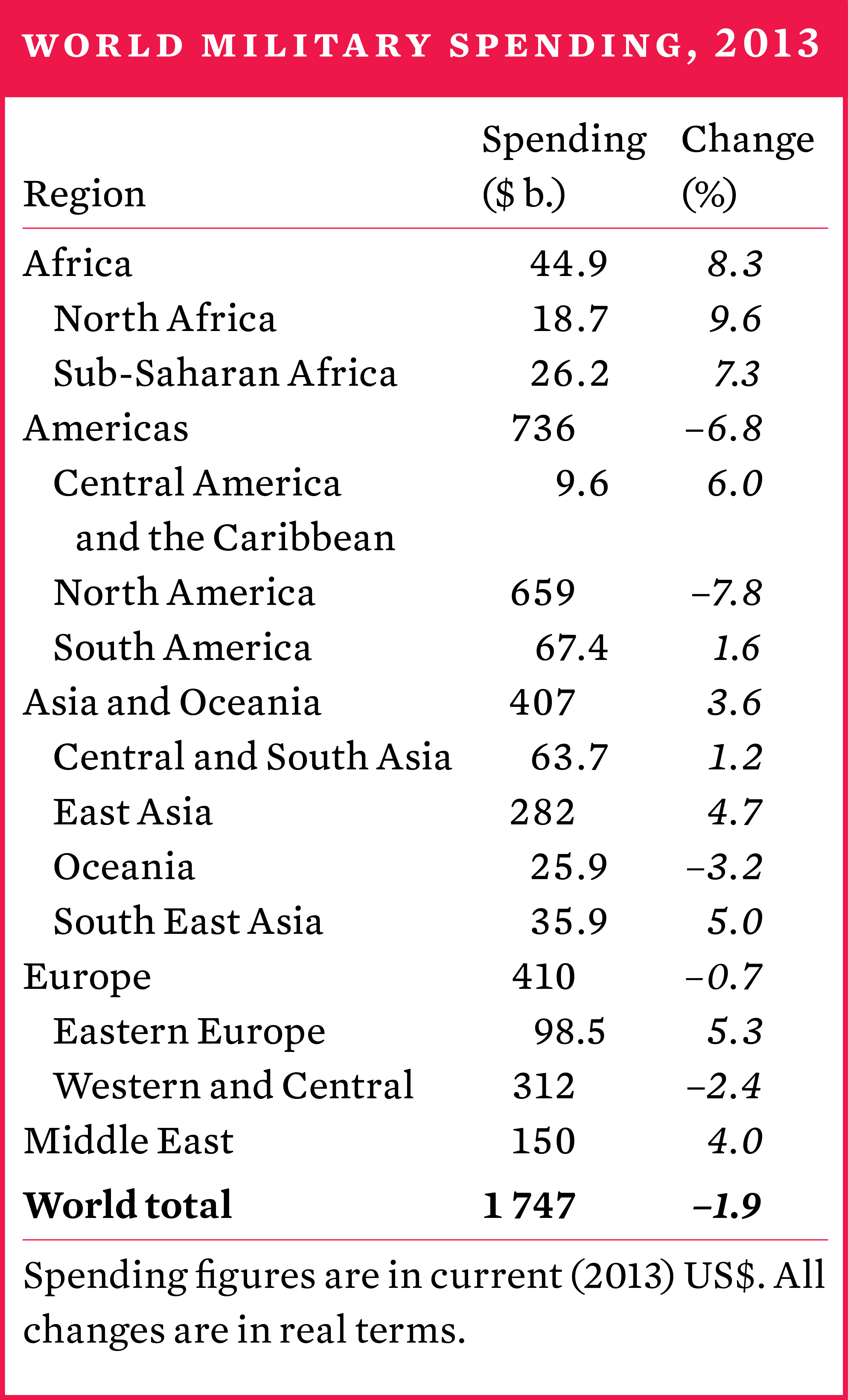

World military expenditure in 2013 is estimated to have been $1747 billion, representing 2.4 per cent of global gross domestic product or $248 for each person alive today. The total is about 1.9 per cent lower in real terms than in 2012.

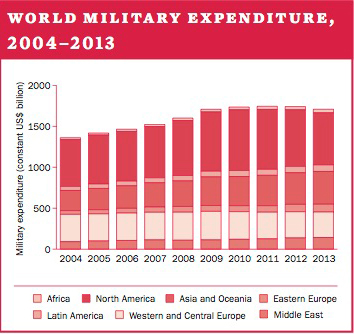

The pattern of increases and decreases in military spending in 2012 continued in 2013, with falls in Western countries (North America, Western and Central Europe, and Oceania) and increases in the rest of the world. There were particularly large increases in Africa and the Middle East, while the impact of austerity policies continued to be felt in Europe. The United States remained the largest military spender in 2013, followed at some distance by China and Russia.

World military expenditure now appears to be following two divergent trends: a falling trend in the West, driven by austerity, efforts to control budget deficits and the winding up of long wars; and increasing trends in the rest of the world, due to a combination of economic growth, security concerns, geopolitical ambitions and, frequently, internal political factors. While the first may play itself out in the coming few years, leading to stable spending or renewed increases, the second shows no sign of abating.

US military spending

US military spending continued to fall due both to the final withdrawal of US forces from Iraq at the end of 2011 and to the impact of the 2011 Budget Control Act on the ‘base’ defence budget. While budgetary gridlock continued during most of 2013, including a brief government shutdown, a congressional deal at the end of the year finally allowed a full budget to be passed, including a defence budget for 2014. While the agreed 2014 budget will mitigate the impact of the Budget Control Act, total US military spending will still fall with the coming withdrawal from Afghanistan.

The reporting of military expenditure data to the UN

The United Nations Report on Military Expenditures remains an important source for official data on military expenditure. However, the response rate of UN member states to the annual request to submit data continued to decline in 2013.

The political sensitivity of military expenditure may be a primary reason for not reporting in some cases, but many of them make their military budgets available online to the general public. Equally, the fact that many countries have responded at least once suggests that they have the capacity to report but lack the political commitment to respond consistently.

Military spending in the Asia–Pacific

China’s military spending has led a strong rise in total military spending in the Asia–Pacific region for some time. In recent years this has been accompanied by increasing tensions due to territorial disputes in the South and East China seas. At the same time, the US ‘pivot’ to Asia has drawn attention to the region’s strategic importance, while China’s rise continues to reshape the security environment. Although concerns over China’s rise are a key driver of military spending for some countries with which China has maritime territorial disputes, maritime issues remain a key factor for other countries that enjoy better relations with China.

Arms production and military services

Declining military spending in the USA and Western Europe was reflected in a decline in the military-related sales of the Top 100 arms-producing and military services companies worldwide, excluding China, which fell by 4 per cent in 2012. However, there was a sharp increase in the arms sales of Russian companies, again reflecting the major rearmament programme being pursued by Russia.

There were substantial increases by the largest companies in a number of other ‘emerging’ producers, such as Brazil, South Korea and Turkey. Overall, the pattern of recent years shows a gradual diffusion of the arms industry, with the traditional producers in the USA and Western Europe responsible for a slowly shrinking share of the Top 100 arms sales and the share of new players growing. However, the traditional producers remain overwhelmingly dominant.