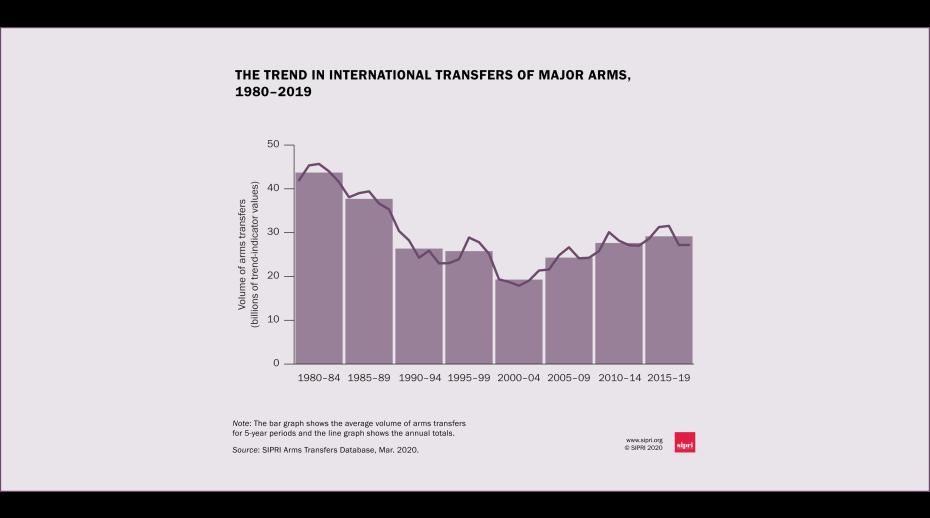

(Stockholm, 9 March 2020) International transfers of major arms during the five-year period 2015–19 increased by 5.5 per cent compared with 2010–14. According to new data from the Stockholm International Peace Research Institute (SIPRI), the largest exporters of arms during the past five years were the United States, Russia, France, Germany and China. The new data shows that the flow of arms to the Middle East has increased, with Saudi Arabia clearly being the world’s largest importer.

Significant increase in arms exports from the United States and France

Between 2010–14 and 2015–19, exports of major arms from the USA grew by 23 per cent, raising its share of total global arms exports to 36 per cent. In 2015–19 total US arms exports were 76 per cent higher than those of the second-largest arms exporter in the world, Russia. Major arms transferred from the USA went to a total of 96 countries.

‘Half of US arms exports in the past five years went to the Middle East, and half of those went to Saudi Arabia,’ says Pieter D. Wezeman, Senior Researcher at SIPRI. ‘At the same time, demand for the USA’s advanced military aircraft increased, particularly in Europe, Australia, Japan and Taiwan.’

French arms exports reached their highest level for any five-year period since 1990 and accounted for 7.9 per cent of total global arms exports in 2015–19, a 72 per cent increase on 2010–14. ‘The French arms industry has benefited from the demand for arms in Egypt, Qatar and India,’ says Diego Lopes Da Silva, SIPRI Researcher.

Notable decrease in Russian arms exports

Major arms exports by Russia decreased by 18 per cent between 2010–14 and 2015–19. ‘Russia has lost traction in India—the main long-term recipient of Russian major arms—which has led to a sharp reduction in arms exports,’ says Alexandra Kuimova, SIPRI Researcher. ‘This decrease was not offset by the increase in Russian arms exports to Egypt and Iraq in 2015–19.’

Arms flows to countries in conflict

Arms imports by countries in the Middle East increased by 61 per cent between 2010–14 and 2015–19, and accounted for 35 per cent of total global arms imports over the past five years. Saudi Arabia was the world’s largest arms importer in 2015–19. Its imports of major arms increased by 130 per cent compared with the previous five-year period and it accounted for 12 per cent of global arms imports in 2015–19. Despite the wide-ranging concerns in the USA and the United Kingdom about Saudi Arabia’s military intervention in Yemen, both the USA and the UK continued to export arms to Saudi Arabia in 2015–19. A total of 73 per cent of Saudi Arabia’s arms imports came from the USA and 13 per cent from the UK.

India was the second-largest arms importer in the world over the past five years, with its neighbour Pakistan ranking 11th. ‘As in previous years, in 2019 India and Pakistan—which are nuclear-armed states—attacked each other using an array of imported major arms,’ says Siemon T. Wezeman, Senior Researcher at SIPRI. ‘Many of the world’s largest arms exporters have supplied these two states for decades, often exporting arms to both sides.’

The United Arab Emirates (UAE) has been militarily involved in Libya as well as Yemen over the past five years and was the eighth-largest arms importer in the world in 2015–19. Two-thirds of its arms imports came from the USA during this period. In 2019, when foreign military involvement in Libya was condemned by the United Nations Security Council, the UAE had major arms import deals ongoing with Australia, Brazil, Canada, China, France, Russia, South Africa, Spain, Sweden, Turkey, the UK and the USA.

In 2015–19 there were again armed clashes between Armenia and Azerbaijan. Both countries are building up their military capability through imports, including missiles capable of attacking targets inside each other’s territory. Russia accounted for almost all of Armenia’s arms imports over the past five years. A total of 60 per cent of Azerbaijan’s arms imports came from Israel and 31 per cent from Russia.

In 2015–19 Turkish arms imports were 48 per cent lower than in the previous five-year period, even though its military was fighting Kurdish rebels and was involved in the conflicts in Libya and Syria. This decrease in imports can be explained by delays in deliveries of some major arms, the cancellation of a large deal with the USA for combat aircraft, and developments in the capability of the Turkish arms industry.

Other notable developments

- Germany’s arms exports were 17 per cent higher in 2015–19 than in 2010–14.

- China was the fifth-largest arms exporter in 2015–19 and significantly increased the number of recipients of its major arms: from 40 in 2010–14 to 53 in 2015–19.

- South Korea’s arms exports rose by 143 per cent between 2010–14 and 2015–19 and it entered the list of the top 10 largest exporters for the first time.

- Israeli arms exports increased by 77 per cent between 2010–14 and 2015–19 to their highest-ever level.

- West and Central European states had outstanding orders at the end of 2019 for imports of 380 new combat aircraft from the USA.

- Egypt’s arms imports tripled between 2010–14 and 2015–19, making it the world’s third-largest arms importer.

- Brazil’s arms imports in 2015–19 were the highest in South America, accounting for 31 per cent of the subregion’s arms imports, despite a 37 per cent decrease compared with 2010–14.

- South Africa, the largest arms importer in sub-Saharan Africa in 2005–2009, imported almost no major arms in 2015–19.

For editors

The SIPRI Arms Transfers Database is the only public resource that provides consistent information, often estimates, on all international transfers of major arms (including sales, gifts and production under licence) to states, international organizations and non-state groups since 1950. It is accessible on the Arms Transfers Database page of SIPRI’s website.

SIPRI’s data reflects the volume of deliveries of arms, not the financial value of the deals. As the volume of deliveries can fluctuate significantly year-on-year, SIPRI presents data for five-year periods, giving a more stable measure of trends.

This is the second of three major data launches in the lead-up to the publication of SIPRI’s flagship publication in mid-2020, the annual SIPRI Yearbook. The third data launch release will provide comprehensive information on global, regional and national trends in military spending.

Media contacts

For information and interview requests contact SIPRI Communications Officer Alexandra Manolache (alexandra.manolache@sipri.org, +46 766 286 133) or SIPRI Communications Director Stephanie Blenckner (blenckner@sipri.org, +46 8 655 97 47).